Some Known Facts About Mortgage Broker Average Salary.

Wiki Article

Our Mortgage Broker Vs Loan Officer Ideas

Table of ContentsWhat Does Mortgage Broker Job Description Do?Facts About Broker Mortgage Fees UncoveredThe Only Guide for Broker Mortgage MeaningFascination About Broker Mortgage Fees7 Simple Techniques For Mortgage Broker Job DescriptionTop Guidelines Of Mortgage Broker AssistantWhat Does Mortgage Broker Average Salary Do?The smart Trick of Broker Mortgage Meaning That Nobody is Talking About

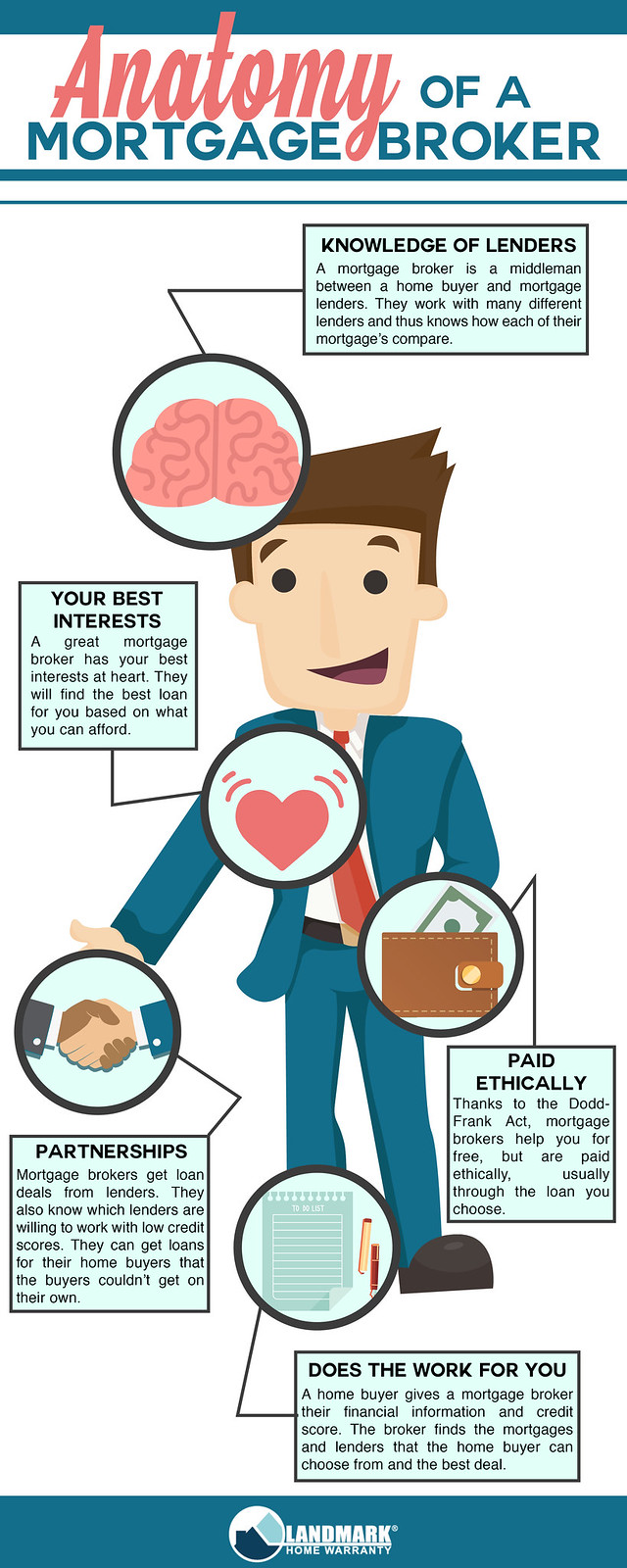

What Is a Home loan Broker? A home loan broker is an intermediary between a banks that supplies loans that are safeguarded with actual estate and also people curious about getting realty that require to borrow money in the form of a funding to do so. The home mortgage broker will work with both parties to get the specific accepted for the finance.A home mortgage broker generally collaborates with numerous different lenders as well as can use a selection of funding choices to the borrower they deal with. What Does a Home mortgage Broker Do? A home mortgage broker intends to finish property transactions as a third-party intermediary between a debtor and a loan provider. The broker will certainly gather info from the individual and also go to several lenders in order to find the very best possible loan for their client.

Mortgage Broker Assistant Can Be Fun For Everyone

All-time Low Line: Do I Need A Home Mortgage Broker? Collaborating with a mortgage broker can conserve the borrower time and initiative during the application procedure, and possibly a great deal of money over the life of the financing. On top of that, some loan providers work exclusively with home loan brokers, indicating that customers would certainly have access to loans that would otherwise not be offered to them.It's crucial to take a look at all the costs, both those you could need to pay the broker, along with any type of fees the broker can help you stay clear of, when weighing the decision to function with a home mortgage broker.

The 5-Second Trick For Mortgage Broker Meaning

You have actually probably listened to the term "home loan broker" from your realty agent or close friends that've bought a residence. What specifically is a home loan broker and what does one do that's different from, say, a finance policeman at a bank? Nerd, Purse Overview to COVID-19Get answers to concerns about your mortgage, traveling, financial resources and also keeping your comfort.What is a mortgage broker? A home mortgage broker acts as an intermediary between you as well as prospective loan providers. Mortgage brokers have stables of lenders they function with, which can make your life less complicated.

Not known Incorrect Statements About Mortgage Broker Average Salary

Exactly how does a home loan broker make money? Mortgage brokers are usually paid by lenders, occasionally by customers, however, by legislation, never ever both. That regulation the Dodd-Frank Act Forbids home mortgage brokers from billing hidden fees or basing their compensation on a borrower's interest price. You can also pick to pay the home loan broker on your own.The competition and residence rates in your market will certainly contribute to dictating what home loan brokers cost. Federal regulation restricts just how high my sources settlement can go. 3. What makes home mortgage brokers different from loan police officers? Loan police officers are workers of one lender that are paid established incomes (plus benefits). Car loan policemans can compose just the sorts of finances their employer picks to provide.

Some Known Questions About Mortgage Broker Job Description.

Home loan brokers might be able to give consumers access to a wide selection of finance types. You can save time by utilizing a home loan broker; it can take hrs to apply for preapproval with various loan providers, then there's the back-and-forth communication involved in underwriting the car loan and also making certain the transaction remains on track.When choosing any kind of lending institution whether via a broker or straight you'll desire to pay attention to loan provider costs." After that, take the Loan Price quote you get from each lender, position them side by side as well as contrast your rate of interest price as well as all of the costs and closing costs.

The Ultimate Guide To Mortgage Broker Job Description

5. Just how do broker mortgage vs bank mortgage I choose a home loan broker? The best way is to ask pals as well as relatives for recommendations, yet make certain they have really made use of the broker and also aren't simply going down the name of a previous university roommate or a distant associate. Learn all you can regarding the broker's services, communication style, level of expertise as well as approach to clients.

What Does Mortgage Broker Association Mean?

Competition and also residence rates will certainly influence just how much home mortgage brokers earn money. What's the distinction in between a home mortgage broker and a loan policeman? Mortgage brokers will work with several lending institutions to discover the very best finance for your situation. Lending officers help one lender. Exactly how do I find a mortgage broker? The most effective means to find a home loan broker is with references from family, pals as well as your realty agent.

Our Mortgage Brokerage PDFs

Buying a new home is among the most intricate occasions in a person's life. Feature differ greatly in regards to design, facilities, institution district and, certainly, the constantly crucial "place, location, location." The home mortgage application procedure is a complicated aspect of the homebuying process, specifically for those without previous experience.

Can figure out which problems could develop difficulties with one lending institution versus one more. Why some buyers stay clear of home loan brokers Often buyers really feel extra comfortable going straight to a large bank to protect their funding. In that instance, purchasers ought to at the very least talk to a broker in her latest blog order to recognize every one of their choices concerning the type of loan and also the available price.

Report this wiki page